Paul Krugman has a neat little post on bubbles. He writes:

The point, whether prices are involved or not, is that the expectations of individuals add up to an aggregate impossibility. Bubbles are in fact “natural Ponzi schemes”, in which Bernie Madoff’s place is taken by the invisible hand of confusion.

Social contrivances like fiat currencies are not bubbles because these contrivances can last forever without any failure. They do exist on a basic human element called trust, which is also an emergent property of social systems (similar to value). These emergent properties are present in complex systems existing in critical states, which means that they can alter very rapidly (avalanche effect). Trust can vaporize very quickly. Ask a properly run bank that suffered a failure during the first Great Depression because of a rumor that the bank will fail. Though Krugman reassures us that fiat currencies are not going away any time soon, it is important to remember the (potentially) fragile foundation that they stand on.

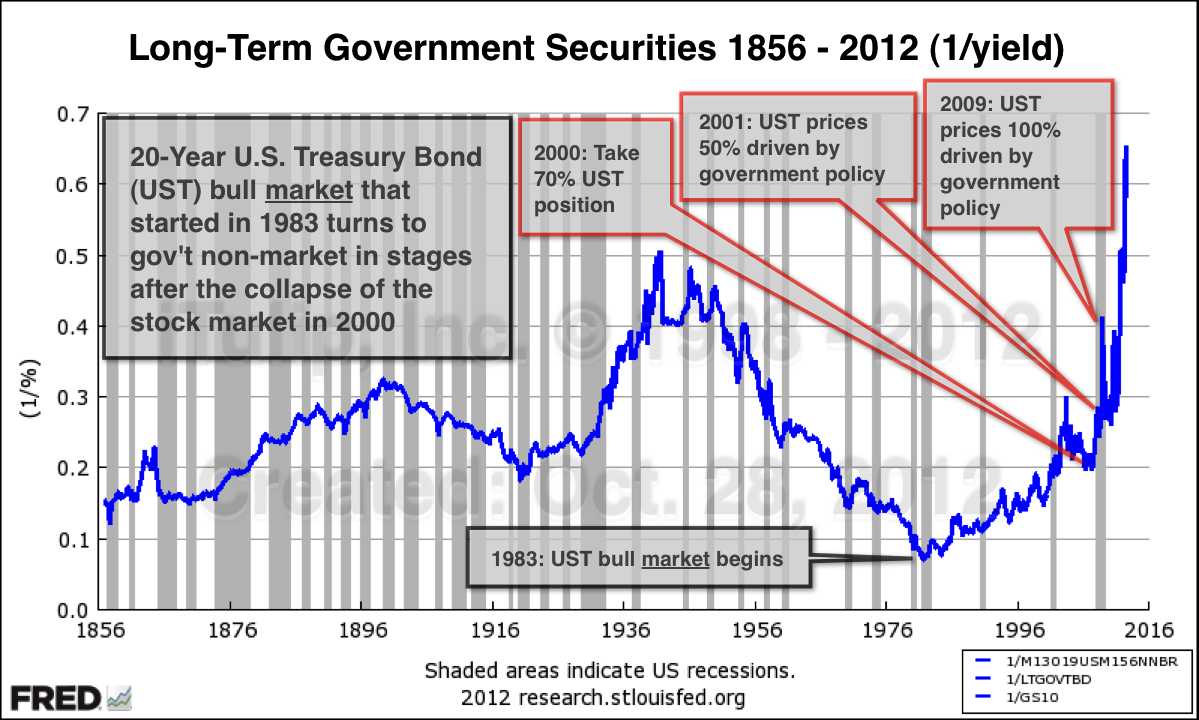

Let us take Krugman's clear definition of bubbles and apply it to a hugely overpriced asset called the US Treasuries. I say overpriced because the price of bonds have never been this high, ever. Courtesy of the excellent chart makers at itulip , here are a few pictures.

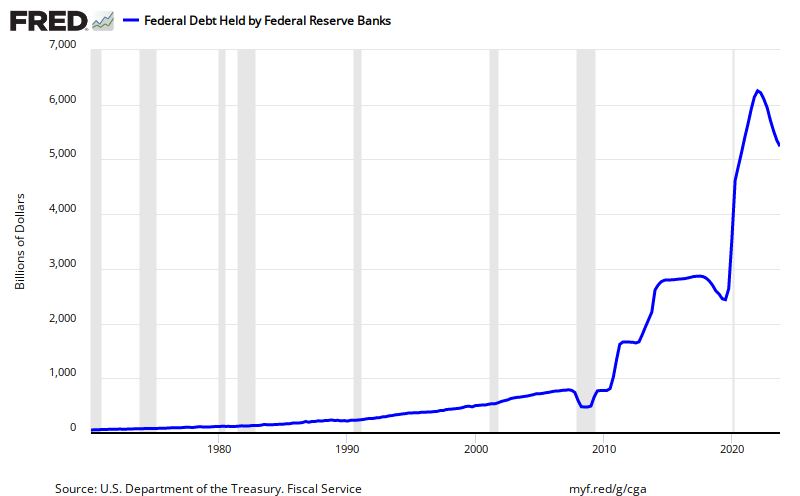

The insanely overpriced bonds are possible by the theoretically infinite balance sheet of the Fed where they can swap base money for US Treasuries.

Anybody who was brave enough to short US Treasuries in 2008 (following the advice of Peter Schiff) got clobbered because of two reasons: a) US Treasuries are still a safe haven in the world's consciousness and b) the Fed stepped in big-time with quantitative easing programs which have led Treasury prices to rise even further, due to nonlinear effects. Can bond prices go on rising forever?

Sure, the Fed's balance sheet is infinite (theoretically). But is it infinite? As analyst Eric Janszen points out intelligently:

What then about gold, which is anti-correlated to the real interest rates? As Krugman points out in one of his blog entries on gold:

Is a Treasury bond (or its inverse, gold) in a bubble? Depends on the level of trust (or otherwise) in the system and whether this assessment of trust adds up to an aggregate impossibility.

Let us take Krugman's clear definition of bubbles and apply it to a hugely overpriced asset called the US Treasuries. I say overpriced because the price of bonds have never been this high, ever. Courtesy of the excellent chart makers at itulip , here are a few pictures.

The insanely overpriced bonds are possible by the theoretically infinite balance sheet of the Fed where they can swap base money for US Treasuries.

Sure, the Fed's balance sheet is infinite (theoretically). But is it infinite? As analyst Eric Janszen points out intelligently:

Because the Fed's balance sheet isn't really infinite. It is only infinite for as long as everyone believes that it is.To tie together the thoughts of Krugman and Janszen, individuals expecting bond prices to rise indefinitely, complicated further by the fact that central banks acting as a bidder of last resort -- this situation can continue only as long as it can't.

What then about gold, which is anti-correlated to the real interest rates? As Krugman points out in one of his blog entries on gold:

The logic, if you think about it, is pretty intuitive: with lower interest rates, it makes more sense to hoard gold now and push its actual use further into the future, which means higher prices in the short run and the near future. But suppose this is the right story, or at least a good part of the story, of gold prices. If so, just about everything you read about what gold prices mean is wrong.Brad Delong points this out well in his entry on gold boom:

On this interpretation gold is and always has been a super Treasury bond: a very long duration asset that is or at least is perceived to be "safe" in the sense that its price does not trade at a discount (due to risk and default premia) from a Treasury bond of the same duration but instead trades at a premium.As more certainty emerges on future outlook and expectations, interest rates adjust to them and gold price being sensitive to long-term interest rates will also adjust accordingly.

Is a Treasury bond (or its inverse, gold) in a bubble? Depends on the level of trust (or otherwise) in the system and whether this assessment of trust adds up to an aggregate impossibility.

No comments:

Post a Comment